The purpose of customer surveys is to listen to the customers' voices. Depending on when and how we ask them about their experiences — from the first time they interact with our product or service, through buying it, to actually using it — there are different ways and methods we can use.

Over time, many companies have conducted surveys, which has led to some standardization in survey methods. When we want to gauge customer satisfaction, we usually use these types of surveys.

Types of Customer Surveys

Customer Effort Score (CES)

Customer Effort Score (CES) is a customer experience metric which measures how easy it is for customers to use your product or service, solve a problem with help, or find the information they want. It also covers one’s communication experience with customer representatives. It’s a helpful metric for assessing the overall customer acquisition and onboarding experience.

Customers rate their effort on a 1-7 rating scale, with 1 being extremely easy and 7 being extremely difficult. The overall score is calculated by dividing the sum of customer effort ratings by the total number of submissions. As people prefer an effortless onboarding experience, lower CES indicates a higher satisfaction and is considered a positive metric.

However, because we intuitively think that a higher score is better, some companies switch it around to make it easier for respondents to answer. For example, they would phrase the question something along the lines of: “It was very easy to submit a helpdesk request.” Then score how much they agree with this statement, 1 being strongly disagree and 7 being strongly agree. In this case, a higher CES score is considered the positive metric.

Net Promoter Score (NPS)

Net Promoter Score (NPS) measures how satisfied a customer is about your product, and how likely they are to recommend it to others. In other words, it measures how many of your customers are so happy that they would become ‘promoters’ of your product.

The survey is very simple, it asks one question: “On a scale from 0 to 10, how likely are you to recommend our company to a friend or colleague?” If they answer 9 or 10, they fall within the promoter range. 7-8 are passives, who are neutral customers who are somewhat satisfied but can easily switch to another product. Anyone who scores 0-6 are referred to as detractors, who are unhappy customers who might negatively impact the brand.

NPS is calculated by subtracting the percentage of detractors from the percentage of promoters. For example, if 70% of respondents are promoters, 20% passives and 10% detractors, the NPS would be 70 minus 10, which is 60. It means for NPS, higher the score, the more satisfied your customers are.

Customer Satisfaction Score (C-SAT)

Customer Satisfaction Score (C-SAT) measures the overall level of satisfaction. Your product solves different problems for each customer, and C-SAT is a handy tool to grasp a comprehensive understanding of your product’s performance before digging deeper.

C-SAT surveys ask: "How satisfied are you with our product/service?" Customers rate their satisfaction on a qualitative scale of ‘Very Satisfied’, ‘Satisfied’, ‘Neutral’, ‘Unsatisfied’ and ‘Very Unsatisfied’. C-SAT is then calculated based on the percentage of customers who gave positive responses (satisfied or very satisfied). For example, if 40 customers responded ‘Very Satisfied’ and ‘Satisfied’ out of 50 survey respondents, your C-SAT would be 80.

General Feedback Form

On top of these qualitative frameworks, it is common practice to collect qualitative data from customers through more general customer feedback surveys. These include open-ended questions to gather opinions on specific experiences, star ratings to measure overall experience satisfaction, or multiple-choice options to inquire about the most satisfying or dissatisfying aspects of an experience.

Surveys, Now with Customer Segmentation and Scoring

However, surveys can go much further than this. Customer surveys are not just about collecting simple data; they are a process of building a strong foundation for understanding customers. For maximum efficiency in building this crucial understanding, it is essential to implement mechanisms for segmenting and scoring respondents. This way, we can derive conclusions beyond simply saying, "Out of 100 customers, 80 would recommend our product to others." Instead, we can say, "Among 100 customers, those we acquired organically are more likely to recommend our product to others.” This process allows us to obtain contextual data alongside customer sentiments.

Different from general, large-scale surveys, segmentation surveys are targeted at specific segments. Psychographic segmentation based on their values, needs and intentions are as powerful as demographic segmentation by age or geography. Let's take a look at examples of surveys with segmentation and scoring.

Customer Segmentation to Identify Needs

This survey is a satisfaction survey form for the dating app ENFPY. This survey goes beyond simply asking what aspects of the app users are satisfied or dissatisfied with; it includes questions that segment customers in various ways.

In addition to gender and age group, the survey asks about users' previous experiences with other dating apps and whether they have met someone through ENFPY. By doing so, the survey segments customers based on both demographic and behavioral data related to their app usage. The multiple questions that ask about what specific features the users liked and want more of can be connected to particular customer categories identified by their behaviors and preferences.

Identifying Hot Leads Alongside Satisfaction Surveys

Here is an example from AWS, where they used Smore to conduct lead scoring during a webinar feedback survey. The survey not only measures satisfaction but also includes questions that specifically identify "hot leads."

The first five questions are general lead collection questions, followed by detailed questions about session satisfaction. After measuring satisfaction, the survey asks about session difficulty, whether respondents plan to use the service within six months, and if they would like to have further discussions with AWS technical staff. By arranging these questions in sequence, AWS could not only measure satisfaction but also identify "hot leads" who are interested in using their services.

Evolving Surveys with Smore - Powerful and Efficient

With Smore, you can create surveys that go beyond simple satisfaction inquiries and delve into lead segmentation and scoring. This doesn't require complex logic. Smore offers ready-to-use templates for personality tests, score quizzes, true/false quizzes, and more, allowing you to gain deeper insights into customers and leads through well-structured questions.

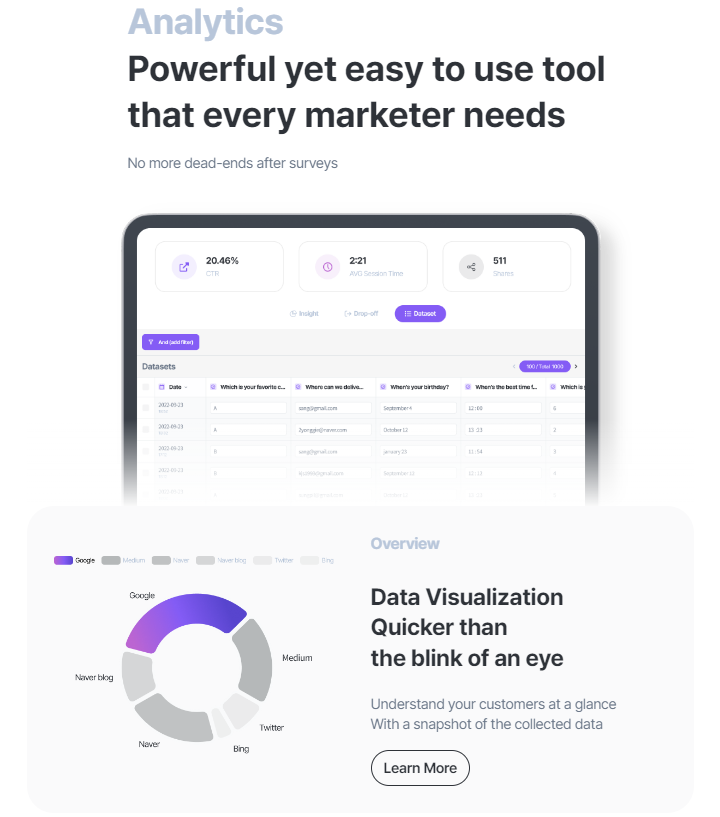

Moreover, you can utilize Smore's easy and powerful analytics to measure results. You can measure counts, completion rates, click-through rates, and other marketing insights by response. Understanding the channels where "hot leads'' are located, filtering responses by demographics, and gaining insights into question-specific dropout rates are also possible.

Take a step closer to your customers with Smore